Roth 401k employer match calculator

A 401k match is money your employer contributes to your 401k. In 2022 the total contributions that an employee and employer can make to a 401k cannot exceed 100 of the employees salary.

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Step 5 Determine whether the contributions are made at the start or the end of the period.

. For example an employer might offer matching contributions of 3 or 6 if an employee chooses to contribute 6 of their salary to the 401k. Participate in a 401k Plan. Under a safe harbor plan employers can select between two contribution options.

If your employer will match 401k contributions in full up to 3000 then your best bet is to put 3000 into your 401k to get that benefit. The IRS allows plans to reach up to 61000 in combined employeremployee contributions. General guidance on participating in your employers plan.

This is the big one. You fund this account by contributing a set percentage of your paycheck into the account. The employer can match 100 of the employees first 3 contribution plus 50 of the subsequent 2.

61000 67500 if youre age 50 or older includes salary deferral amount and employer matches. Maximize Employer 401k Match Calculator. Heres a hypothetical example.

A 401k is an employer-sponsored tax-advantaged retirement plan. A 401k is an employer-sponsored savings plan that lets you set aside pre-tax dollars or after-tax dollars if you have a Roth 401k from your paycheck to help fund your retirement years. KPMG 401k match New employees are eligible to join KPMGs 401k plan after 60 days of joining the company.

20500 27000 if youre age 50 or older. What Is a 401k Match. Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account.

Step 7 Use the formula discussed above to calculate the maturity amount of the 401k. Income taxes on matching funds also are deferred until savings are withdrawn. This is the type of contribution that can be made as pre-taxtax-deferred or Roth deferral or a combination of both.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Travelers matches employee contributions dollar-for-dollar up to 5 percent of eligible. It shares certain similarities with a traditional 401k and a Roth IRA although there are important.

If youre 50 or older you can add an additional 6500 per year for a total of 27000. Mid-year Amendments to Safe Harbor 401k Plans and Notices. The Roth 401k is somewhat different from the traditional 401K as a retirement savings plan.

Operating a 401k plan. In addition many employers will match a portion of your contributions so participation in your employers 401k is like giving yourself a raise and a tax break at the same time. Additionally as the employer you can make a profit-sharing contribution up to 25 of your compensation from the business up to 58000 for tax year 2021 and the maximum 2022 solo 401k contribution is 61000.

And the Roth component of a Roth 401k gives you the benefit of tax-free. In 2022 you can invest up to 20500 a year in a 401k 403b or in most 457b plansnot including the employer match. If you contribute 6000 yearly and realize a 6 average annual return at the end of 20 years you could have 233956 in your retirement account.

The employer can match 100 of the first 4 of employee contributions. One of the hallmarks of a 401k plan is that they allow individuals to contribute to their own retirement. Correct a 401k Plan.

A Roth 401k gives you a similar tax me. And may make either pre-tax 401k or after-tax Rothk contributions. With this key job benefit your employer adds to the money you save boosting your 401k account over the long term.

How your savings could add up. The employer can contribute 3 of compensation to all employees that are eligible. A 401k is an employer-sponsored retirement plan that lets you defer taxes until youre retired.

Thats a lot of money. Total contribution limits for 2022. An employer-sponsored Roth 401k plan is similar to a traditional plan with one major exception.

Heres what to think about before changing your contribution. Consider investing in your employer-sponsored tax-advantaged retirement account. How to establish designated Roth accounts in a 401k plan.

Funds are added directly to your 401k account. Salary deferral limits for 2022. With a Roth 401k you can take advantage of the company match on your contributions if your employer offers onejust like a traditional 401k.

With their tax-free earnings and large contribution limits Roth 401ks could be a useful addition to the retirement-savings toolbox. A 401k offers a lot of benefits match or no match. One of the biggest perks of a 401k plan is that employers have the option to match your contributions to your account up to a certain point.

You make pre-tax contributions and pay tax on withdrawals in retirement. While the annual IRA contribution limit of 6000 may not seem like much you can stack up significant savings. The Roth 401k was introduced in 2006 and combines the best features from the traditional 401k and the Roth IRA.

From there you can divide your remaining 2000. As a benefit to employees some employers will match a portion of an employees 401k contributions. They can enroll and elect to make 401k contributions through payroll.

Operate and Maintain a 401k Plan. A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. Often these contributions come in the form of an employer 401k match.

A 401k is a type of retirement savings plan typically sponsored by employers to attract and retain employees.

401k Contribution Calculator Step By Step Guide With Examples

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

401k Contribution Calculator Step By Step Guide With Examples

401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

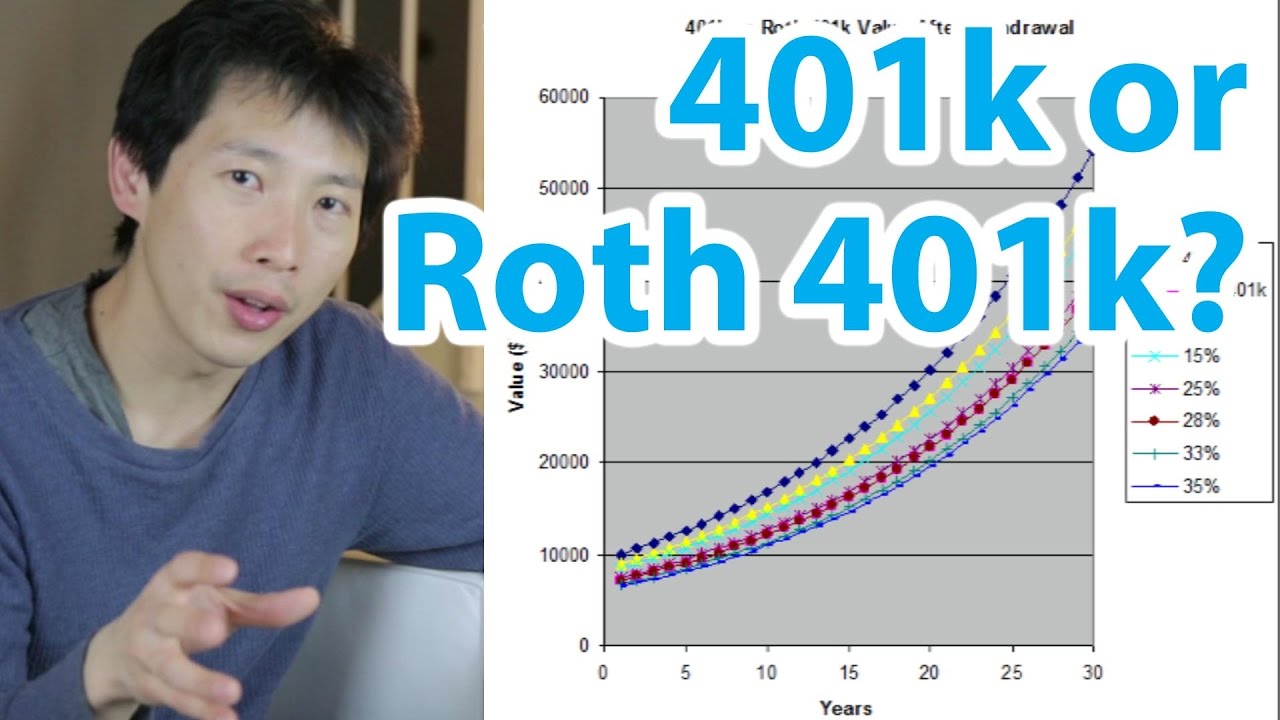

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Free 401k Calculator For Excel Calculate Your 401k Savings

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401 K Contribution Limits For 2022 Kiplinger

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur

Free 401k Calculator For Excel Calculate Your 401k Savings

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

401 K Plan What Is A 401 K And How Does It Work

Free 401k Calculator For Excel Calculate Your 401k Savings

Solved After Tax Roth 401 K Employee Deductions Company Contributions